General Information About Ethereum

Ethereum Cryptocurrency Guide: In this article, we will provide general information about Ethereum, which has rapidly gained traction in the cryptocurrency world after Bitcoin. This will help you build a knowledge base for future activities, such as trading and mining, allowing you to gain experience in all related metrics.

What is Ethereum?

During a Bitcoin Conference held in North America, Ethereum was introduced by its founder, Vitalik Buterin. After this introduction, there was a demand that even the founder and his team did not foresee. While all coins other than BTC are referred to as altcoins, Ethereum has become a unique creation and seems to be increasing in value day by day. The difference between this appreciation and that of other altcoins lies in the greater innovations.

Ethereum can be defined as a well-managed and rapidly spread project that serves as a cryptocurrency operating system. Created with a blockchain structure similar to BTC, Ethereum certainly has its unique features. For example, it addresses the slow transfer issues faced by BTC using a different programming language. Due to its use of a proprietary programming language, it operates among decentralized protocols.

This allows the creation of various altcoins as desired, all under a single operating system through a single blockchain. Individuals investing in cryptocurrencies foresee Ethereum as the future BTC.

What Are the Differences Between Ethereum and Bitcoin?

As you may know, there are no identities in any coin systems. You are given identities made up of letters and numbers, generated completely by algorithms. These identities are produced randomly according to a complex computer system.

Both coins utilize cryptography and distributed ledger technology.

Ethereum uses a programming language called Solidity, while Bitcoin is based on a Stack architecture programming language.

Bitcoin verifies a transfer in a minimum of 2 minutes before sending it to the target identity. This duration can sometimes take minutes or even hours.

In contrast, the verification and transfer time for Ethereum takes about 10 seconds on average.

Bitcoin employs the SHA-256 cryptographic encryption and secure hash sending algorithm.

Ethereum, on the other hand, uses the Ethash algorithm.

While these are the main systematic differences, let’s discuss the differences based on usage and need analysis:

- The primary purpose of BTC is to serve as an alternative payment method similar to tangible monetary instruments (Euro, Dollar, Gold).

- Ethereum, however, aims to be a currency that can be used directly in purchases, facilitating transactions via Ethereum wallets for applications and similar payments.

- The common structure of both can be defined as a basic payment protocol.

Today, it is possible to make payments using Bitcoin for many services, including hosting, VPN, and servers. In fact, in our country, there are trading platforms for buying and selling Bitcoin and Ethereum.

Is Ethereum Reliable?

One theme you might have noticed from the beginning of this article is the constant comparison between Bitcoin and Ethereum. It’s rarely that Ethereum is discussed on its own. When you review articles online, you will likely encounter these comparisons. But why is that?

- Do people not trust Ethereum?

- Are people doubtful about Ethereum’s future?

- Are articles affecting the uncertainty about investing?

- Is there no logical explanation for what Ethereum is?

Individuals involved in the coin systems frequently ask themselves these questions. These are likely to lead to an increase in questions as they ponder them. Let’s answer the most curious ones together.

Do People Not Trust Ethereum?

This is a reasonable and highly valid question. Ethereum, looking back 8-9 months, had a market presence trying to establish itself, progressing at an average rate like other altcoins and not drawing much attention. Its past has instilled fear in people. It has become a matter of fear rather than trust, resulting in Ethereum’s price remaining at an average level.

The history of a coin brand is indeed important. The fundamental point is: “What is its current position compared to where it started?” When people recognize this, they tend to invest significantly. If we do not consider Bitcoin’s situation over the last 5 years, its market value and the community it has built today, it would be unfair. So, interpret this not as investment advice, but as a perspective that allows for logical thinking.

Are People Concerned About Ethereum’s Future?

Certainly. We must advise newcomers to coin systems not to invest without thorough research. As mentioned earlier, the rapid increase in Ethereum’s prices has unfortunately generated future concerns within this market. While the fundamental reason for the rise is often viewed as mining, it’s essential to remember that Bitcoin mining is still ongoing.

Are Articles Affecting the Uncertainty About Investing?

Absolutely not. The reason for the constant comparisons in articles is that Ethereum has distinguished itself among altcoins and gained significant brand value in the market. Thus, articles are written using comparative operators due to Ethereum’s rapid establishment of brand value, suggesting that the market will develop positively for Ethereum in the long term.

Is There No Logical Explanation for What Ethereum Is?

This article thoroughly demonstrates what Ethereum is. By researching Bitcoin further, you can easily understand that they are all based on the same logic.

How Did Ethereum Shine?

After reading all this information, you might want to learn more about why Ethereum shone. Therefore, if we do not provide information about this, we will not have fully answered the question, “What is Ethereum?”

As mentioned above, Ethereum was launched with a better and more innovative infrastructure that addressed the problems faced by Bitcoin. Let’s recall those points:

- Predictive future analyses were made, allowing the creation of a structure that could adapt to maximum demand.

- A decentralized marketplace resulted in a pricing situation shaped entirely by needs. Thus, values reflecting reality were created through supply-demand relationships instead of being managed by a single entity.

- There are no boundaries when making or receiving payments. With digital identities, you can perform transactions without revealing your identity or sharing any information. While you can do this with other coins as well, we want you to understand the other three points clearly.

- We cannot ignore the increasing investment demands. After Bitcoin, individuals looking to invest in altcoin systems especially chose Ethereum. There must be a reason for this, right?

- Major global corporations have significantly supported Ethereum. This has showcased how solid this digital currency system is to the public.

- As mentioned earlier, Bitcoin is facing performance issues. Transaction times are getting longer every day, with demand and usage steadily increasing, causing performance problems to grow exponentially. The division parody experienced in August is a prime example of this. During this process, Bitcoin dropped from its price of over $3000 to as low as $1800. This once again instilled trust in Ethereum. Moreover, transaction fees in BTC can rise to exorbitant amounts like $4. While this may seem low, it is a significant amount for those who are tired of the banking system and seeking decentralized currency.

- Transactions on Ethereum are much faster, cheaper, and more secure. Time is money.

What Will Ethereum’s Price Be?

After gathering all this information, another question lingers in your mind: “Should I invest?” We do not want to leave you feeling guilty or triumphant by telling you to invest or not. We prefer to spark ideas in your mind based on solid foundations.

What will Ethereum’s price be?

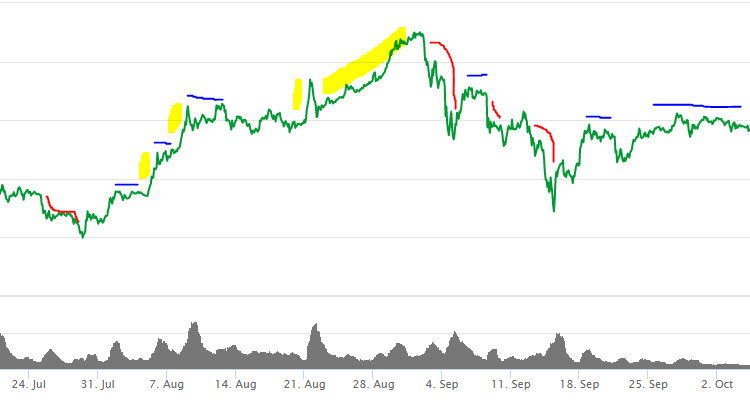

The areas marked in red are shown as buying curves.

The yellow areas represent profit zones.

The blue straight lines indicate waiting phases.

In the graph above, we present Ethereum’s values over the last three months. For example, on June 8, it was $280, but on June 10, it dropped to $242. There is a $38 difference here. Investors continuously monitor these fluctuations. This slight drop is referred to as a buying curve. You should aim to make your purchase at a more favorable price during this drop. You can achieve significant profits in a short time.

When Do We Buy?

At the beginning of the second red line, the ETH price is $230. From here, our second buying curve begins, and a buying curve forms between June 13 and June 16. During this three-day period, the base price reaches $149. You need to exhibit patience here. Panic and fear will cause you losses. You should purchase at this point. On June 18, it reaches $240. If you had closely monitored the average decline and bought 10 ETH at around $180, you would have had the opportunity to sell those 10 Ethereum for $2400 five days later. This means you could have made a profit of $600.

The key point here is: “You should be patient and let the impatient person’s money flow to the patient.” Impatient and panicky individuals will panic at the sight of a decline and sell to recover their funds. This leads to further declines in price. Those who are patient will collect Ethereum at the lowered price, and when the market normalizes, their average profit will be at least 30%.

The areas marked in blue are waiting zones. You can benefit from these slight declines as well. The entire process boils down to patience.

When Do We Sell?

This entirely depends on your financial situation. If you look at the money invested in the stock market as disposable, you will lose. This money will gain or lose value over time. The money you invest in the stock market should be significant for you, and if you will need this money in a few days or weeks, we do not recommend making such an investment. For example:

Let’s say you have $2500 to invest. Ethereum was hovering around $310 as of October 8, 2017. Let’s round it to $300. On September 15, it dropped to $200. If you had bought 10 at $200, you would have made $1000 in about 20 days. We cannot guarantee that Ethereum won’t drop to $260 tomorrow. Set aside your profit and buy again when it drops. If it hits $290, you’ll make $300 from 10 coins. Short drops and rises can yield quick profits.

About Ethereum Mining

If you are afraid of investing in the stock market or think you can’t handle it, you can consider Ethereum mining. You can perform mining operations similarly to building a computer with hardware products. However, in the long run (6-10 months), you will recover your investment for free. Moreover, you can use the system you built later or mine other coins.

For this, we recommend reading another meticulously prepared article available on our site.